New York-based investment advisors Two Sigma Investments LP and Two Sigma Advisers LP have settled SEC charges and repaid funds after a researcher made unauthorized changes to the firm’s investment models used to make investment decisions. Known collectively as “Two Sigma,” the firm paid $90 million in civil penalties to settle the SEC claims, then voluntarily repaid $165 million to affected funds and client accounts. Continue reading

New York-based investment advisors Two Sigma Investments LP and Two Sigma Advisers LP have settled SEC charges and repaid funds after a researcher made unauthorized changes to the firm’s investment models used to make investment decisions. Known collectively as “Two Sigma,” the firm paid $90 million in civil penalties to settle the SEC claims, then voluntarily repaid $165 million to affected funds and client accounts. Continue reading

Articles Posted in Whistleblower Violation

SEC Sanctions Monolith Resources For Violation Of Dodd-Frank Act

Can a company prohibit former employees from speaking to federal regulators, such as the SEC, and function as a whistleblower? They can certainly try, but it is still illegal.

Can a company prohibit former employees from speaking to federal regulators, such as the SEC, and function as a whistleblower? They can certainly try, but it is still illegal.

Monolith Resources, LLC, based in Nebraska, included language in their employment separation agreements prohibiting departing employees from recovering money through participation in investigations, enforcement actions, or filing claims with the government. This includes participating in the SEC’s Whistleblower program. Continue reading

SEC Charges GPB With Violations Of SEC Whistleblower Protection Laws

The Securities and Exchange Commission (SEC) alleges that GPB Capital Holdings violated whistleblower protection laws by retaliating against a whistleblower and preventing people from going to the SEC with information. Continue reading

The Securities and Exchange Commission (SEC) alleges that GPB Capital Holdings violated whistleblower protection laws by retaliating against a whistleblower and preventing people from going to the SEC with information. Continue reading

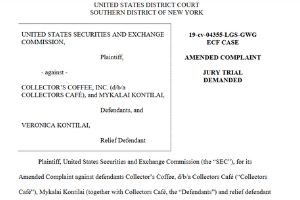

SEC Charges Collectors Café With Violating Whistleblower Protection Laws

The Securities and Exchange Commission (SEC) alleges that Collectors Café, an online memorabilia auction company, and its CEO Mykalai Kontilai, illegally tried to stop investors from reporting misconduct to the government in violation of the SEC’s whistleblower protection rules.

The Securities and Exchange Commission (SEC) alleges that Collectors Café, an online memorabilia auction company, and its CEO Mykalai Kontilai, illegally tried to stop investors from reporting misconduct to the government in violation of the SEC’s whistleblower protection rules.

The SEC already sued Kontilai and Collectors Café for operating a “fraudulent $23 million securities offering based on false statements to investors.” Continue reading

SEC announces another $2.5 million dollar whistleblower award for a former government employee

The Whistleblower business can be very profitable for tipsters, a landmark whistleblower award of nearly $2.5 million was awarded today by the Securities and Exchange Commission. The recipient of this award was the employee of a domestic government agency. Information provided by this whistleblower was instrumental in launching a SEC investigation. The anonymous whistleblower continued to offer assistance and eventually helped expose wide ranging misconduct in an unnamed company.

Jane Norberg, the Chief of the SEC’s Office of the Whistleblower praised whistleblowers and the continued success of the award program.

”Whistleblowers can provide a wealth of information and ongoing assistance that helps our agency bring enforcement actions quicker and more efficiently,” She also noted the speed allowed by the assistance of whistleblowers.’ “This whistleblower not only helped us open the case, but also provided timely ongoing assistance along with critical documents and testimony that accelerated the pace of our enforcement action.”

SEC Orders Half-million Dollar Penalty for Firing Whistleblower

On September 29, 2016, the Securities and Exchange Commission (the “SEC”) announced that casino-gaming company International Game Technology (“IGT”) agreed to pay a $500,000 penalty for firing an employee who reported to senior management and the SEC that the company’s financial statements might be distorted.

The whistleblower retaliation case is the second of its kind since the Dodd-Frank Act authorized the agency to bring retaliation charges. According to the SEC order, the employee had been a director of an IGT division since 2008 and received positive performance reviews throughout his time with the company and never received any sort of discipline or corrective action.

The whistleblower received a favorable evaluation in the 2014 mid-year review and was deemed an employee on the rise, according to the order. Shortly after that review, the whistleblower raised concerns to his managers, to the company’s internal complaint hotline, and to the SEC that IGT’s publicly-reported financial statements may have been misstated. Approximately three months after the whistleblower raised his concerns, according to the order, IGT terminated him.

Anheuser-Busch InBev Pays $6 Million to Settle Charges that is Violated Whistleblower Protection Laws

The Securities and Exchange Commission announced on September 28, 2016 that Anheuser-Busch InBev agreed to pay $6 million to settle charges that the company violated the Foreign Corrupt Practices Act (FCPA) and attempted to silence a whistleblower who reported the misconduct.

An SEC investigation found that the company used third-party sales promoters to make improper payments to government officials in India to increase the sales and production the company’s products in India. According to the SEC order, Anheuser-Busch InBev repeatedly ignored employee complaints, had inadequate internal accounting controls to detect and prevent the improper payments, and failed to ensure that transactions involving the promoters were recorded properly in its books and records.

Additionally, according to the order, the SEC found that Anheuser-Busch InBev entered into a separation agreement that stopped an employee from continuing to voluntarily communicate with the SEC about the potential FCPA violations due to a substantial financial penalty that would be imposed for violating strict non-disclosure terms.

Atlanta-based Company Paying Penalty for Violating Important SEC Whistleblower Protection Rule

Atlanta-based building products distributor BlueLinx Inc. is settling charges that it violated an important whistleblower protection rule by using severance agreements that required departing employees to waive their rights to monetary recovery should they file a charge or complaint with the Securities and Exchange Commission (the “SEC”) or other federal agencies.

BlueLinx has agreed to pay a $265,000 penalty per the SEC’s order.

According to the SEC’s order, BlueLinx’s restrictive provisions were an attempt to bar employees from filing charges against the company and to keep their mouths shut if the company ever committed any securities law violations. The restrictive language in the agreements essentially forced employees leaving the company to waive possible whistleblower awards or risk losing their severance payments and other post-employment benefits.

SEC Whistleblower Lawyer Blog

SEC Whistleblower Lawyer Blog